Poland’s approach to European integration of the dairy sector combines tradition (cooperative movement) and progressive thinking (innovation and investment in sustainable development), which has given a good chance to turn the dairy industry into a successful example of economic growth.

As part of the preparation of the EU Integration Roadmap for Ukrainian dairy sector, the European Integration Committee of the Union of Dairy Enterprises of Ukraine held an expert discussion of Poland’s experience in this area. The meeting participants analysed what lessons learnt can be applied to the Ukrainian industry and what conclusions should be laid down for the future Roadmap.

The event brought together Andrzej Babuchowski, Expert on EU Dairy Sector Integration, Agnieszka Maliszewska, First Vice President of COGECA and Director of the Polish Chamber of Milk, as well as Marcin Hydzik, President of the Polish Association of Milk Processors (ZPPM). The meeting was moderated by Marс Gramberger, Managing Director of Prospex International.

In the first article following the event, we looked at the stages of Poland’s preparation for the EU’s common market, the financial instruments that facilitated this, and the adaptation of sanitary standards in milk production and processing to EU requirements. Now we will focus on the role of cooperatives in the Polish dairy market and how the market is adapting to the European Green Deal.

The role of cooperatives

The agricultural cooperative movement in Poland dates back to the 19th century, when farmers began joining forces to collectively process and sell their products. During the interwar period, cooperatives grew rapidly, becoming a key part of the Polish economy. After World War II, they were subordinated to the centrally planned economy, losing some of their independence. After 1989, they regained their autonomy, and today, large cooperatives such as Mlekovita and Mlekpol dominate the dairy market and compete successfully on international markets.

“Two co-operatives control about 50% of the Polish market — they are powerful, sustainable structures. For farmers, this model is valuable because they not only do business together, but also share responsibility, particularly in times of crisis, such as during the pandemic. Their strength lies not only in joint lobbying, but also in the mutual exchange of knowledge and experience,” said Agnieszka Maliszewska, First Vice President of COGECA and Director of the Polish Chamber of Milk.

According to her, thanks to the cooperation and lobbying of cooperatives, the Milk Promotion Fund was established in Poland in 2009. Its goal is to promote Polish milk and dairy products both on the domestic and foreign markets. The fund is managed by the Milk Promotion Fund Management Committee, which includes representatives of dairy producers and processors, and chambers of agriculture.

The fund is financed by contributions from the sale of raw milk for processing in the amount of PLN 0.001 per litre of milk. The funds are used for advertising campaigns, educational programmes (e.g. “Drink milk — be healthy”), participation in export promotion exhibitions and research activities.

Amounts allocated for the implementation of projects from the Polish Milk Promotion Fund

| Year | Amount in PLN |

| 2024 | 17 741 123,21 |

| 2023 | 15 099 203,79 |

| 2022 | 12 115 131,14 |

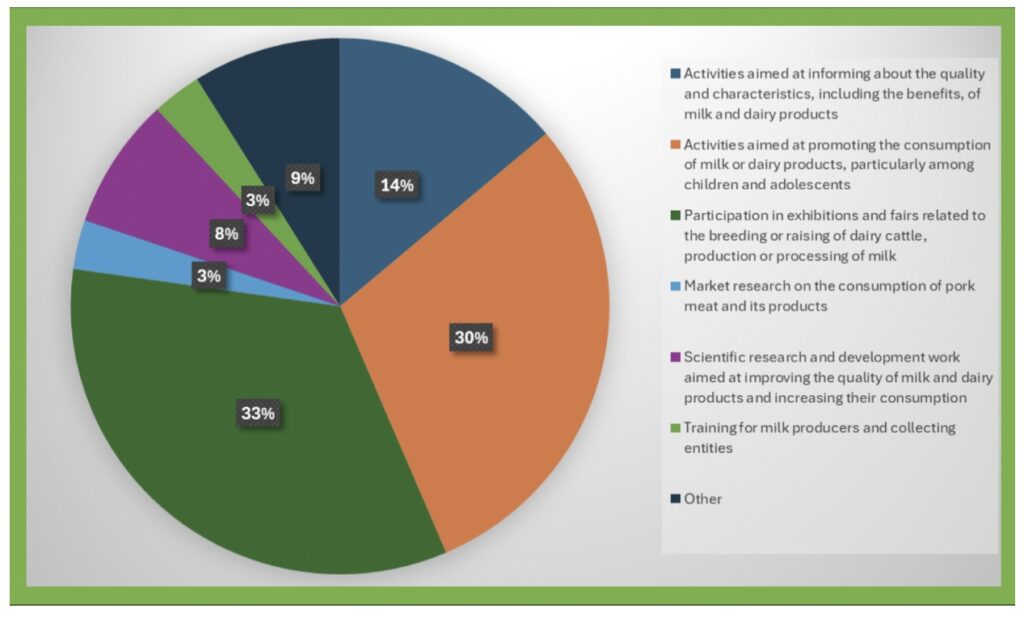

Structure of the Fund’s distribution in 2024

Dairy cooperatives in Poland play a key role in the industry’s sustainable development. How does this work, and why has the association of producers and processors helped increase opportunities for investment in environmental initiatives?

One successful example of a sustainable solution is the Spółdzielnia Mleczarska Mlekpol dairy cooperative, which includes 8,000 farmers and operates 14 processing plants across Poland. Since 2021, Mlekpol has stopped using coal and switched to low-carbon and renewable energy sources, including the construction of a biogas-combined heat and power plant in Grajewo that uses organic waste to produce energy.

The European Green Deal and Poland’s strategy in the dairy sector

Let’s take a closer look at Poland’s strategy within the framework of the European Green Deal. The EU Green Deal and the “Farm to Fork” strategy aim to achieve climate-neutral agriculture by 2050 through the protection of biodiversity, the implementation of sustainable agrotechnologies, the development of a circular economy, and the creation of a sustainable food system that minimises food waste and improves animal welfare.

Despite large-scale farmer protests across the EU in recent years, these goals remain unchanged. However, a key question arises: how can environmental requirements be balanced with the need to support the competitiveness of the European economy?

Within the framework of the Common Agricultural Policy (CAP) for 2023–2027, eco-schemes have been introduced to compensate farmers for sustainable practices such as pasture-based feeding and responsible waste management. Poland’s CAP Strategic Plan emphasises farm modernisation and compliance with environmental standards.

At the same time, the Polish Strategy for Sustainable Rural Development, Agriculture and Fishery 2030 focuses on supporting small family farms and promoting agricultural innovation to enhance Poland’s agri-food sector’s global competitiveness.

Polish authorities view the dairy industry as a strategic sector, recognising its significant role in the national economy and are even prepared to prioritise its energy supply in times of crisis.

How do environmental challenges affect the development of Poland’s dairy sector?

Environmental sustainability in dairy production involves reducing greenhouse gas emissions—particularly methane from cows (agriculture accounts for around 9% of total greenhouse gas emissions in Poland)—as well as preserving water resources and soil quality. Effective waste management and biodiversity protection, including animal welfare, are also essential components.

Among the key challenges facing Poland’s dairy sector is the need to ensure economic sustainability — maintaining profitability for both farmers and processors and securing stable incomes in rural communities. Dairy producers in Poland are primarily small-scale farms. Rapid consolidation has resulted in a roughly 70% decrease in the number of farms since 2004, raising concerns that small farmers may be left behind, which could negatively impact rural livelihoods.

In addition, farmers are dealing with milk price fluctuations, volatile demand, and sharp increases in input costs — such as feed, fertilizers, and energy — driven by the pandemic, the war in Ukraine, and inflation. All of these factors combined reduce farm profitability.

Poland is striving to adopt more environmentally friendly dairy production while preserving opportunities for economic growth. The overarching goal is to meet the EU’s climate targets without compromising the sector’s competitiveness. However, achieving sustainability requires new equipment and practices, and many farmers lack sufficient capital to invest. Thus, financing and profitability remain ongoing concerns.

High energy costs and climate goals are pushing Polish dairy plants to save energy. Companies are installing more efficient technological equipment and upgrading their heating systems.

“The main focus now is on reducing electricity and fuel consumption per litre of processed milk. This is our response to rising energy prices. The same applies to water usage. Dairy plants aim to reuse water and minimise waste. For example, they are optimising CIP (clean-in-place) systems to cut down on water consumption. Some factories are even treating and reusing wastewater,” said Marcin Hydzik, President of the Polish Association of Milk Processors.

According to him, instead of discarding waste, companies are transforming it into resources. One example is biogas production from manure or dairy waste, where methane is captured and used for energy. Whey is processed into protein powders or animal feed, helping reduce overall waste.

Large dairy companies are also starting to measure and report their full carbon footprint, including emissions from farms. This requires close cooperation with farmers to gather data and reduce emissions. Currently, only around 55% of companies track emissions across their supply chains, but attention to this area is growing, driven by increasing pressure from EU regulations, consumers, and retailers.

Outcomes of sustainability initiatives in Poland’s dairy sector

Greenhouse gas emission intensity in Poland’s dairy sector is gradually decreasing, thanks to the adoption of energy-efficient solutions such as biogas and solar energy. An increasing number of dairy plants are investing in renewable energy sources, including the installation of biogas units and solar panels, which help reduce dependence on fossil fuels.

At the same time, there is a growing focus on waste management: circular practices are being introduced, allowing the use of whey and manure for biogas production, thereby lowering emissions and wastewater discharge. Companies are also working to reduce water consumption by implementing reuse systems and improving water treatment processes.

A key step forward is the increase in transparency: more and more companies are publishing sustainability reports, which makes it possible to track progress in emissions reduction and responsible resource use. Around 90% of Poland’s leading agri-food companies measure their emissions, and over half are working to assess emissions across their supply chains.

This growing transparency will help monitor future progress in reducing emissions, energy use, and water consumption in the dairy sector.

Instead of a conclusion

Regardless of laws and regulations, companies that neglect the restoration of natural resources expose their businesses to significant operational and financial risks.

“While regulations may increase operating costs in the short term, in the long run, they are intended to help build a more sustainable and resilient food supply chain — one that ensures product quality, reduces the negative environmental and climate impact of production, and improves animal welfare,” says Marcin Hydzik, President of the Association of Polish Milk Processors.

According to him, collaboration among all stakeholders — farmers, processors, retailers, government, and consumers — will be the key factor in transforming Poland’s dairy industry into a “green” engine of economic and social well-being for years to come.

Currently, many sustainability practices in Poland are concentrated in large companies and cooperatives. Thousands of smaller dairy farms and processors have yet to adopt emissions tracking, energy-efficient equipment, or advanced waste management systems. Bringing the entire sector — including smallholders — in line with green standards is a significant challenge.

Initial investments in biogas plants, solar panels, modern barns, and other innovations are high. For small farms, financing such upgrades can be difficult without subsidies. Ongoing financial support and innovative financing mechanisms — such as grants, low-interest loans, and co-financing — will be crucial, especially in light of uncertainties around EU funds.

Upcoming EU regulations may introduce stricter requirements, including potential methane emission limits for large farms, higher standards for manure management, or new packaging waste rules. The sector must prepare to comply without harming production.

Some farmers worry that measures such as herd size limits or mandatory use of costly equipment could threaten their viability. Striking the right balance between regulation and practicality will be a complex task.

This publication has been created by the European Integration Committee of the Union of Dairy Enterprises of Ukraine with the support of Switzerland within the framework of the Swiss-Ukrainian Programme “Higher Value Added Trade from the Organic and Dairy Sector in Ukraine” (QFTP) implemented by the Research Institute of Organic Agriculture (FiBL, Switzerland) in partnership with SAFOSO AG (Switzerland). The content of this publication is the sole responsibility of the author(s) and does not necessarily reflect the views of the development partners, including SECO, FiBL, and SAFOSO AG.