Poland is one of the most successful examples of comprehensive integration of the dairy sector into the European Union (EU) market among relatively new member states, as it joined the EU in 2004.

Poland is one of the most successful examples of comprehensive integration of the dairy sector into the European Union (EU) market among relatively new member states, as it joined the EU in 2004.

Ukraine and Poland are neighboring countries with close logistical ties, making the Polish integration experience practically relevant for Ukraine’s path to the EU.

According to the Polish Chamber of Milk, Poland is the 5th largest milk producer in the EU, following Germany, France, the Netherlands, and Italy, and ranks 14th in the world.

According to the Central Statistical Office of Poland, the country has 148 dairy plants, half of which are small local producers.

It is worth noting that in the early 2000s, despite the prospects of European integration and access to the common European market, Polish milk producers and processors had serious concerns — they feared an increase in imports, the displacement of national products from the market, a reduction in production, and job losses. These same concerns are now being voiced in Ukraine.

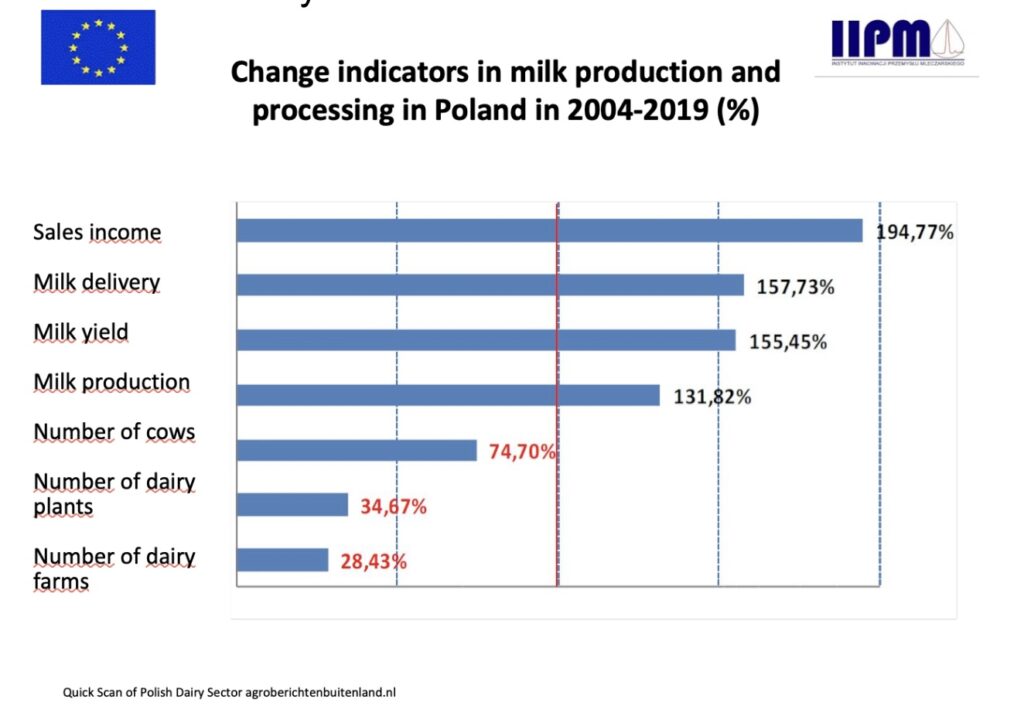

However, despite the initial concerns at the beginning of the European integration path, thanks to EU financial support, substantial co-financing from national public funds, and proper preparation for the common market, milk production in Poland increased 2.3 times from 2004 to 2019, while revenue from milk sales almost tripled.

The growth in production and economic activity is even more impressive given the decline in livestock numbers and operators, indicating a remarkable leap in the sector’s efficiency.

Therefore, it is not surprising that the Polish experience is important and useful for the Ukrainian dairy sector on its path to European integration.

On April 30, European Integration Committee of the Union of Dairy Enterprises of Ukraine (SMPU), as part of the preparation of the EU Integration Roadmap for Ukrainian dairy sector, held an expert discussion on Poland’s experience in this area.

The meeting participants analyzed which lessons can be applied to the Ukrainian sector and what conclusions should be incorporated into the future Roadmap.

The event brought together Andrzej Babuchowski, Expert on EU Dairy Sector Integration, Agnieszka Maliszewska, First Vice President of COGECA and Director of the Polish Chamber of Milk, as well as Marcin Hydzik, President of the Polish Association of Milk Processors (ZPPM).

The meeting was moderated by Marс Gramberger, Managing Director of Prospex International.

Vadym Chagarovsky, President of the SMPU, noted during the expert discussion that Poland has successfully adapted its dairy sector to EU requirements and is now among the leaders in milk and dairy production within the EU.

“Although Ukraine has not yet achieved the same success as Poland, I believe that the Ukrainian dairy sector has great potential and needs to harmonize its regulatory framework with EU requirements,” he said.

Hanna Lavreniuk, General Director of the Ukrainian Milk Producers Association, emphasized that Poland is one of the countries Ukraine should look up to in terms of quality preparation and transformation of the dairy and agricultural sectors to meet EU standards.

According to her, Poland has not only successfully adapted but also preserved its identity and enhanced the competitiveness of its milk producers.

Institutional Basis of European Integration of the Polish Dairy Sector

Before gaining member state status, the European Commission provided Poland with indicators outlining how the Polish dairy sector system should operate during integration into the common European market.

To develop a procedural screening document and the measures required on the path to European integration, the Ministry of Agriculture and Rural Development of the Republic of Poland initiated the Agency for Restructuring and Modernization of Agriculture. This document included financial and technical tools for further European integration, giving Polish operators a clear integration plan to follow.

Modernization priorities in the dairy sector included:

* Improving milk quality

* Organizing milk collection and aligning production with relevant sanitary standards

* Modernizing production lines

“After implementing the measures, we immediately sought feedback from the European Commission regarding their implementation and effectiveness,” said Andrzej Babuchowski, an Expert on EU Dairy Sector Integration.

According to him, the banking system was also simultaneously preparing for further integration with the EU and creating opportunities to provide financing for farmers.

Role of Financial Support

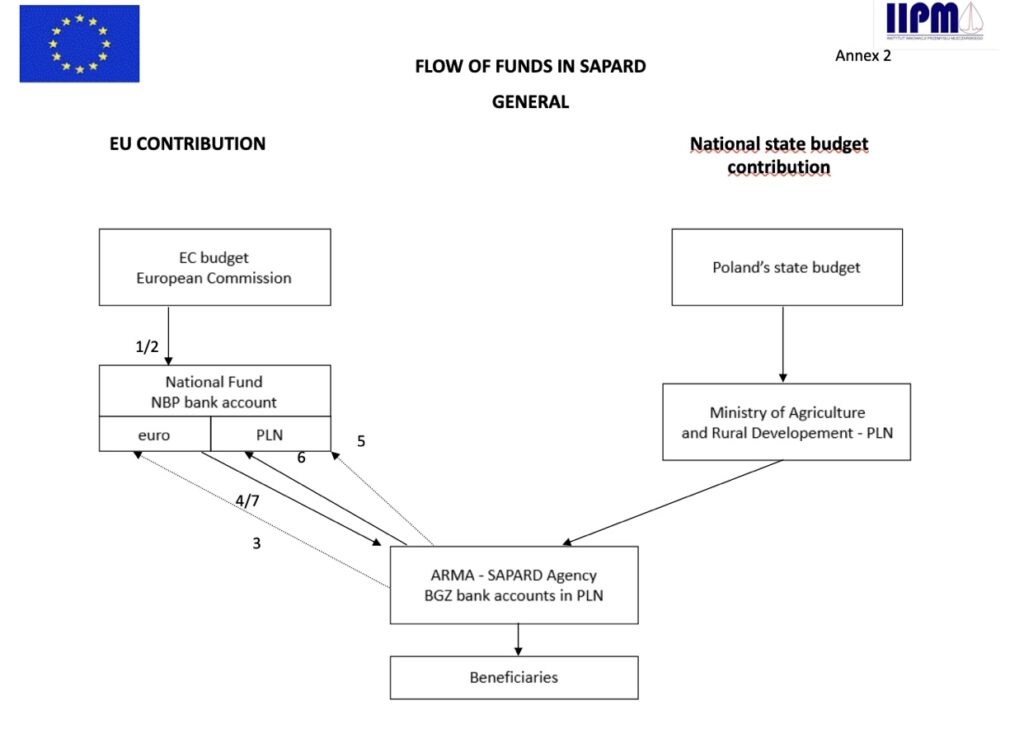

The Polish authorities understood that in order to properly and effectively use EU financial support, it was necessary to ensure co-financing of the dairy sector from national state funds, as well as a high level of efficiency from national institutions responsible for distributing the funds. Farmers and processing enterprises needed to be prepared to receive financial resources and generate their own resources to implement previously prepared projects. In turn, banks and other financial institutions had to be ready to meet the financial needs of companies. As a result, Poland effectively restructured its dairy industry with relatively small amounts from EU support programs.

How it worked?

As part of the national support programmes for the sector, a programme of accessible lending was launched, which provided preferential loans from the Polish Agency for Restructuring and Modernization of Agriculture.

Dairy processing plants could receive financing for modernization to adapt to EU sanitary and veterinary standards, including purchasing equipment for milk processing, quality control, milk collection tanks, and more. Cheese production and processing plants could additionally purchase equipment for packaging and producing processed cheese.

Loans of up to 4 million euros could be obtained for 8 years with a grace period of up to 3 years at an interest rate of 2% per annum.

In 1999, the SAPARD Programme (Special Accession Programme for Agriculture and Rural Development) was additionally established. Its strategic goals were: improving the economic viability of Poland’s agrifood sector both on domestic and international markets; adapting Poland’s agrifood sector to the sanitary, hygienic, and quality standards of the single market; and promoting multifunctional development of rural areas, particularly through the development of technical infrastructure and the creation of conditions for non-agricultural economic activities in rural areas.

The legal basis for the Programme was provided by EU legal acts: Council Regulation (EC) No 1268/99 of 21 June 1999 and EC Regulation (EC) No 2222/2000 of 7 June 2000.

The Programme budget amounted to 1.084 billion euros, consisting of EU funds of 708.2 million euros, 235.8 million euros in national funding, and 140 million euros transferred with the agreement of the European Commission from the Rural Development Plan budget. The implementation of SAPARD began in July 2002.

Under the SAPARD Programme, Polish dairy enterprises attracted funds for the following investment purposes:

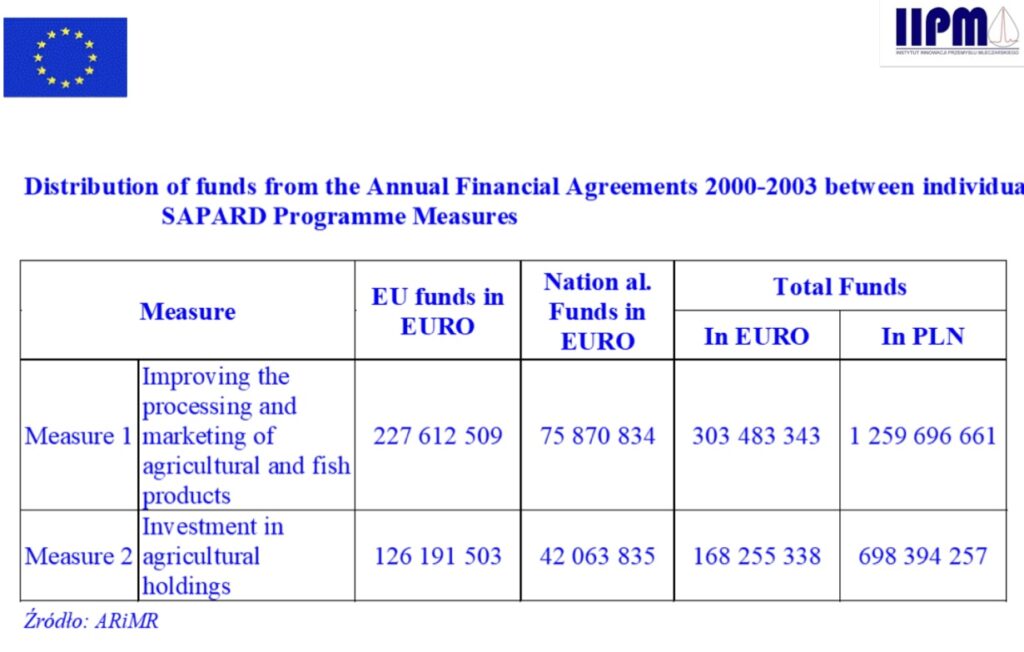

In total, from 2000 to 2003, the SAPARD Programmeallocated 303.5 million euros for the modernization of processing establishments, of which 227.6 million euros were provided by the EU. Additionally, 168.3 million euros were allocated to support milk producers during this period, with 126.2 million euros coming from EU funds.

Sanitary Standards and Product Quality

The priority task for Poland was to ensure sanitary and hygienic standards during the collection and processing of milk, so that their products could be marketed within the EU. It was necessary to prove that Polish products met EU requirements. What needed to be done to ensure the competitiveness of Polish products on the EU market?

“We had to implement a modern quality system despite discussions that the Polish dairy sector could disappear entirely due to the reform. As a result, we decided to focus on implementing ISO and HACCP standards, which contributed to improving the quality of raw milk and bringing production in line with required sanitary norms,” said Andrzej Babuchowski.

In 2002, a categorization of milk processing establishments was conducted, which revealed that out of 413 dairies, 40 fully met EU standards, 181 would be brought into compliance by the date of accession, and 111 would do so by December 31, 2006, while the remaining 81 would cease operations.

As a result of investments in production modernization and the implementation of ISO and HACCP standards, the percentage of “Extra” class milk in the total volume of purchased milk increased from 28.6% in 1998 to 70.1% in 2002.

Investments and encouraging milk producers to improve raw material quality were key factors in the sector’s success. Despite the high EU standards, Poland successfully adapted its dairy industry.

Success Factors of the Polish Dairy Market

Poland presents the most successful example of EU integration in the dairy sector over the past 25 years, which contrasts sharply with the experience of Bulgaria and Romania, where part of the sector remained outside the EU single market.

A high level of compliance with EU requirements became the foundation for full access to the European market, enabling the Polish dairy sector to multiply its production and economic achievements despite the reduction in the number of cows and operators.

“Ukraine can learn from key Polish EU integration solutions, including the creation of internal audits for operators at the national level, the active role of business cooperation, the effective use of EU support for sector modernization, and ensuring equal market access for all participants in the dairy chain,” believes Maksym Fasteev, advisor to the SMPU European Integration Committee. According to him, the Polish experience is not ideal, but it is a reliable reference point. Currently, more than 50 Ukrainian dairy enterprises have the right to export to the EU — a significant achievement compared to Poland at the start of its EU integration. At the same time, other Ukrainian operators must also be included in this system through transparent and publicly accessible certification.

Ukraine’s goal is full integration of the dairy sector into the common EU market, both with the ability to trade within it and to export its own products marked “Produced in the EU” to external markets.

This is the first part of a publication within a series of materials based on the discussion of Poland’s experience with the EU integration of its dairy sector. The second part will be published soon.

This publication has been created by the European Integration Committee of the Union of Dairy Enterprises of Ukraine with the support of Switzerland within the framework of the Swiss-Ukrainian Programme “Higher Value Added Trade from the Organic and Dairy Sector in Ukraine” (QFTP) implemented by the Research Institute of Organic Agriculture (FiBL, Switzerland) in partnership with SAFOSO AG (Switzerland). The content of this publication is the sole responsibility of the author(s) and does not necessarily reflect the views of the development partners, including SECO, FiBL, and SAFOSO AG.